While the world is going through many changes, the one thing that has remained continuous is the fact that Hatch Invest has offered a steady and continuous supply of stock investment for their customers. This is done purely because it is the only website, that offers, low rates buying of US stock market brand shares and offers a great deal.

Though it is mostly a beneficial website, Hatch invests just offers you brands that you can invest in. It doesn’t let you know which one’s are the best or worse. That is something you have to figure out on your own and then carefully invest where you think you will get more profit.

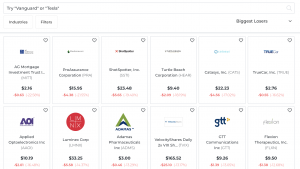

Below are just some of the worst US stocks that you can buy on Hatch Invest.

1. Sears (SHLDQ)

Sears, once a thriving business has cut its costs and dunned reinvestments. Because of this, a once prosperous mail-ordering business is almost bankrupt now and if you invest in this there will be no profit to count.

2. Guess (GES)

Guess, the famous retail store that was once at the top of the retail business is slowly falling in the seams. The introduction to online shopping has devastated this retail chain store and damaged its profits. It would be foolish to invest in a failing business.

3. Watsco Inc (WSO)

Watsco is a company is not like the two mentioned above. They are doing well and are not on the verge of bankruptcy, so why include it in this list? Simply because the product that they design is too overly pricy to its actual worth. This is why it is imperative to be intelligent with you stock buying and investing.

4. Snap Inc (SNAP)

Now, this is an interesting case. Snap Inc, owned by Snapchat made a fortune with its snapchat stories and videos, but the downfall came when Instagram stories along with Facebook stories also popped up and became a lot more famous and used. Due to this, slowly and gradually the user number of Snap Inc decreases and this is why this company is in the list of the worst US stock to buy.

5. Nordstrom (JWN)

Going back to the commonality with all retail stores, online shopping has made almost all retail stores useless. Why buy something from a store when you can online shop. Amazon, being the leading online rand has taken a lot of the usual retail customers under their wing. Due to this retail stores like Nordstrom have been failing and for you as a customer wouldn’t be a wise choice choosing this as the next big US stock to buy.

Summary

These are just a few of the many US stocks that you as a customer should not buy as they will only take you towards loss. Remember, the running theme in the list above are retail stores. Avoid buying shares in retail stores as there will surely pull you towards a loss. That being said, hopefully, this article has helped you understand how to go about buying US stock.